529 Plan Benefits

529 savings plans have many advantages over traditional savings accounts, which can make saving for college easier for families.

Advantages of saving with a 529 plan

- Tax-free Withdrawal – With a 529 Plan, your total savings can be withdrawn tax-free, if used for a qualified educational expense

- Transferability – Funds leftover in your 529 Plan can be transferred to another beneficiary or to a Roth IRA account

- Flexibility – In addition to traditional 4-year college, tuition to community colleges, trade schools, and private K-12 schools are included as qualified educational expenses

- No Age Limits – There are no age limits for anyone looking to open a 529 plan to fund higher education

- No Gift Tax – Donations of up to $18,000 per individual are allowed without tax implications for the donor

- Financial Aid (FASFA) – Qualified distributions from a student-owned or parent-owned 529 account, to pay for the current year’s college expenses, are not included in the calculation of “base-year income” that would reduce eligibility for financial aid.

- Easy Gifting – Anybody can donate to a 529 plan with access from a gift link

- In-State Tuition – 529 prepaid plans let you prepay part or all of an in-state public tuition, locking in the tuition amount at time of payment

- K-12 and Private Schools – 529 Savings Plans were expanded to allow up to 10K per year to pay for K–12 private and religious school tuitions

- Student Loans – 529 Plan funds can be used to pay off up to 10K of a student’s college loans

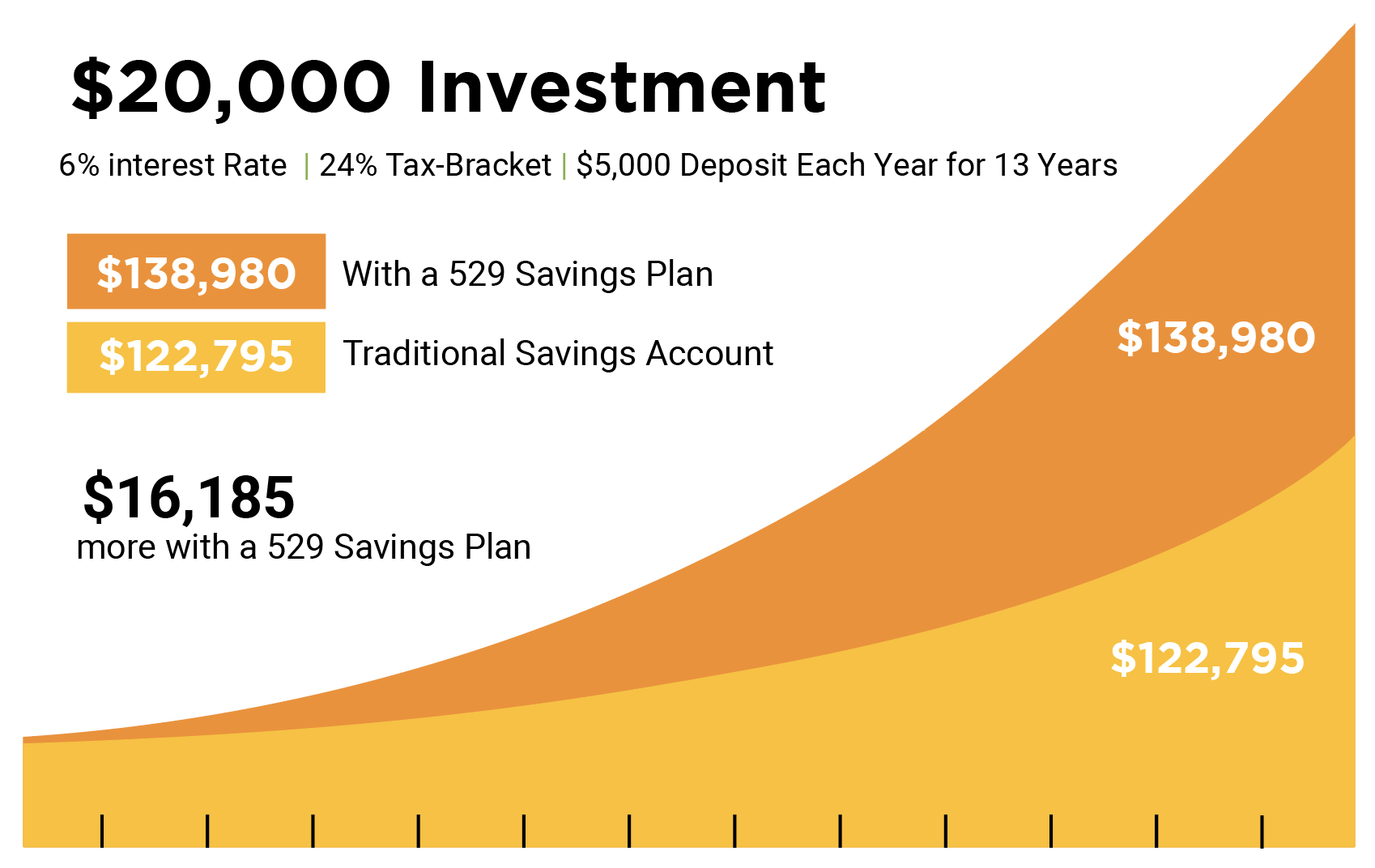

Savings Comparison with a 529 Plan

Save More, Faster, with Perks!

Traditional savings plans can’t provide the same long-term benefits of a 529 Plan. 529 Plans are designed specifically to help make college accessible and affordable for all students!

It’s never too early to start saving!

Disclaimer: The above figures are purely for demonstrative purposes and are based on several discrete financial assumptions. These figures are not meant to guarantee or represent any actual financial results

The Ultimate Savings Duo

MAX529 and your 529 Savings Plan

MAX529 was designed as the perfect enhancement for 529 savings plans. MAX529 accelerates the ability for students and parents to meet thier funding goals and do it faster.

Combine MAX529 and your 529 savings plan, there is no better way to save for your education!

News & Tips

New Law allows 529 Funds to Rollover to Roth IRAs

Starting in 2024, a new law is set to kick in, and it's a game-changer – you can now roll over any...

What Type of 529 Plan is Best For You?

If you're on the rollercoaster ride of planning for your kid's education, you've probably stumbled...

Investing in Education: The Gift of a 529 Plan

Introduction: In a world filled with material gifts, there's one present that stands out for its...

Frequently Asked Questions

What are MAX529 Student Rewards?

Student Rewards are funds that MAX529 deposits into a student's 529 plan for inviting new student subscribers. This allows our members to start earning money right away.

Invite students to join MAX529, and start earning!

Student Subscribers invite other students to subscribe to MAX529 because of all the great tools for saving, but there's more! When you send an invitation, and that person signs up for a student subscription, you start receiving earnings.

Student Rewards are equal to 10% of that new subscriber's monthly membership fee, and this multiplies by every student you refer.

Earnings accumulate month after month and are deposited directly into the student's 529 plan, for the life of the subscription.

There are no limits, the more students you invite, the more MAX529 Reward Dollars you earn each month!

What are MAX529 Bonus Bucks?

MAX529 distributes multiple $100 bonuses, every quarter. This opportunity is offered to all Student Subscribers, every quarter of every year!

The Bonus Bucks are awarded to the subscribers with the most student referrals for the previous 90 days. The number of bonuses available each quarter is determined by the volume of current Student Subscribers, up to 10% of the student members will receive one at each distribution.

Bonus Bucks funds are deposited directly into your 529 savings plan.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education expenses. These plans, legally known as "qualified tuition plans," allow for a tax free withdrawal when used for qualified education expenses, which can save thousands when paying for private school, college, or trade school!

Why should I choose MAX529?

MAX529 provides multiple ways to save money for school, fundraise and earn actual money every month.

MAX529 allows you to easily grow your 529 plan to its fullest potential. Through gifts links, you can enable friends and family to contribute to your plan whenever they please.

Students who keep their dashboard updated will be eligible for bonus funds from MAX529 up to 4 times every year.

MAX529 has a money back guarantee; if your total paid in subscriptions does not exceed the amount of money saved in your 529 plan, MAX529 will contribute the difference directly to your plan!

Are there contribution limits?

There are no yearly contribution limits to a 529 plan like certain retirement accounts. However, each state has a different aggregate contribution limit for each 529 account, typically between $235,000 and $550,000.

How do I get started?

Its easy! Those who subscribe to MAX529 will register, create a profile, and link their existing 529 plan to their account; from there, gift links can be sent out to recipients at the click of a button!

What does it cost?

A Student Subscriber account is just $5.29/month and a one time registration fee of $10. You can begin maximizing your savings, earning rewards, and connecting with colleges as soon as you sign up!

Does MAX529 Administer 529 Plans?

No, MAX529 is meant to be used to enhance an exisitng or new 529. MAX529 makes use of "Gift Links" to allow friends and family members to contribute directly and securely to a plan.

I have student loans, will this help?

Yes, up to $10,000 from your 529 savings plan can be applied to your student loans.

What if my child doesn't go to college?

Not to worry, your savings will not go to waste! Per the Internal Revenue Code, funds in a 529 plan can be transferred to another beneficiary with no penalty, or they can be rolled into a Roth IRA!